The Buzz on Insurance

Wiki Article

Getting My Insurance To Work

Table of ContentsInsurance Things To Know Before You BuyTop Guidelines Of InsuranceThe Facts About Insurance UncoveredSome Ideas on Insurance You Should KnowRumored Buzz on InsuranceThe Of InsuranceRumored Buzz on InsuranceSome Ideas on Insurance You Need To Know

If you choose to do it on your own, making the calls is the hardest part of the process. "Contrast shopping internet sites are really just lead generation solutions," Clark says. As insurance policy is state controlled, Clark would love to see each state create an on-line comparison-shopping tool.Each vehicle insurance quote need to be based on the very same amount of coverage so you can do an apples-to-apples comparison. This is the simplest part of learning just how to shop for auto insurance! What if a poorly ranked business uses you a fantastic quote?

Insurance - Truths

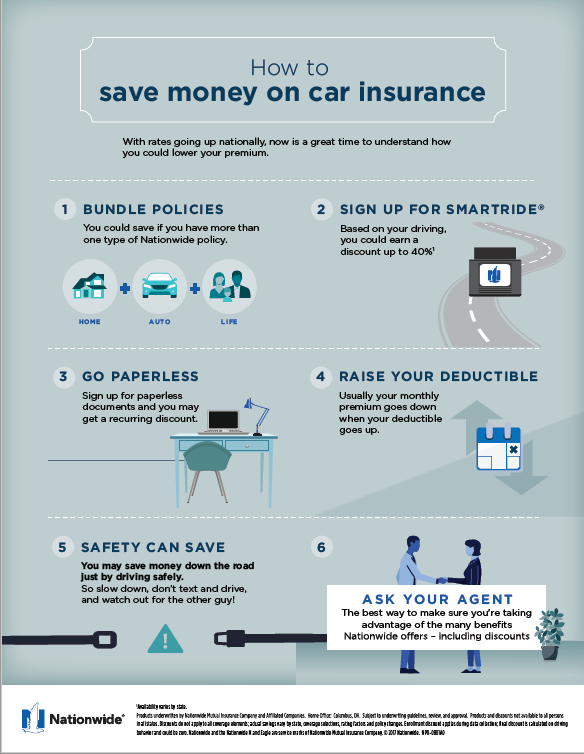

Great, cheap auto insurance is available; it simply takes a little buying around to find it! That's why it's so important that you know just how to shop for auto insurance coverage. Whenever you're considering switching insurance providers, make sure to take notice of a firm's document with client satisfaction as well as complaint resolution (insurance).You're going shopping around for auto insurance policy. What do you need to know? Well, there are great deals of methods a minimum of 11 that you can save money. Most of these money-saving concepts may apply to you. Do you have a house owners or occupants insurance coverage plan? If so, is it with the very same insurance provider that offers your auto insurance? If the answer is no, you're paying way too much for both policies.

The 8-Minute Rule for Insurance

These insurance companies supply supposed multi-policy discount rates. Usually, these discounts are at the very least 10% and some insurers use the discounts to both the vehicle and also the homeowners/renters plan. Speak to your representative about multi-policy price cuts. It's clear that the much better your driving record, the much less you will certainly pay for car insurance policy.Lots of auto insurance providers are in fact a collection of a number of insurer in which each deals with a specific kind of chauffeur. The most awful drivers enter one company, the finest in one more, and a great deal of people wind up in one of the center business. These center people pay much less than the most awful chauffeurs, yet greater than the most effective.

Some Known Incorrect Statements About Insurance

These middle individuals are paying much more. Why? The typical factor is that they don't recognize any type of far better. No one told them which insurance provider in the group had the most effective costs. And also, probabilities are, no person even told them there was a group of insurance provider. If you have a clean driving document, there's no factor you should not be paying the cheapest rate a team of insurance provider has to offer.

Our Insurance Statements

Rates can differ considerably from state to state. Someone living in New Jersey, Massachusetts or Hawaii pays several times a lot more, on average, than someone in North Dakota, South Dakota or Idaho.

Top Guidelines Of Insurance

Many insurance firms now utilize your credit report as a significant consider establishing what to bill you for automobile insurance. In many cases, with some business, you might conserve money by changing your service to an insurance provider that utilizes credit report as a score factor also if you have a moderate or inadequate driving document.

If you have a bad credit report, you might save cash by moving your vehicle insurance coverage to a company that does not make use of credit history as a score variable. Lots of insurers do not make use of credit as an element. Despite your credit history status, you should speak with your representative to make sure you have the most effective scenario provided your credit score document, excellent or poor.

Excitement About Insurance

The majority of business offer a discount rate for the additional business. It's not simply for vehicle insurance policy plans; according to Bankrate, you can additionally conserve by packing residence or tenant's insurance coverage with your auto insurance. Allstate gives a 25 percent price cut on house owner's protection as well as a 10 percent car discount when you combine both policies (insurance).On the various other hand, moving infractions that carry factors on your driving document, such as speeding, will additionally raise your vehicle pop over here insurance costs. The insurance deductible is the amount of money you pay out of pocket if you have an automobile insurance coverage case.

Facts About Insurance Uncovered

You may be able to conserve money on auto protection with unadvertised price additional info cuts. Ask concerning saving money for affiliation with specific groups, choosing for online policy details, or paying your whole costs price in development. Contrast the discount rate costs with those from other insurance firms to get the very best readily available price - insurance.Some states even call for insurers to supply this kind of discount. Cost isn't whatever when it comes to selecting the appropriate auto insurance policy business.

Report this wiki page